However, there are some differences in the values that appear in the equations. First, the service department costs (Siand Sj) are different because all of the self service and reciprocal relationships are considered in determining these amounts. In addition, theproportions (Kji) in both sets of equations are different for the same reason. The proportions reflect all of the relationships in the reciprocalmethod, instead of only part of the relationships as in the step-down method. In conclusion, reciprocal costs are shared expenses incurred by multiple departments or activities within an organization, posing challenges for accurate cost allocation.

How Liam Passed His CPA Exams by Tweaking His Study Process

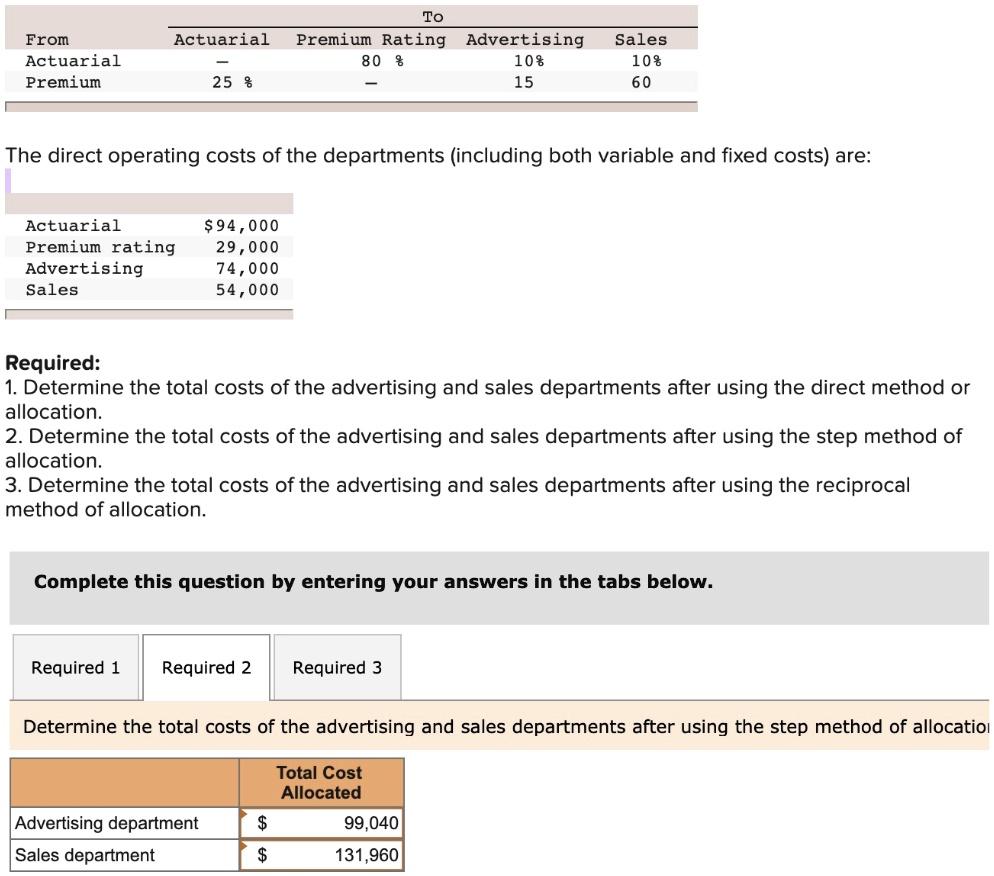

The service departments, Power and Maintenance provide support to the producingdepartments, Cutting and Assembly, to each other and also use some of their own services. These estimates are used todevelop predetermined departmental overhead rates for the Cutting and Assembly departments. In the second step, the equations for the service departments are solved first in the sequence established by the rules mentioned above. Then the equations representing theproducing departments are solved to provide the desired allocations. The step-down method is more accurate than the direct method, but less accurate thanthe reciprocal method.

Advances in Accounting

Traditional costing methods might allocate these overheads uniformly across products, leading to distorted cost information. In contrast, ABC ensures that overheads are allocated based on actual resource usage, providing a more accurate picture of product costs. This accuracy is crucial for pricing decisions, product mix optimization, and profitability analysis. For example, a company might discover through ABC that a seemingly profitable product is actually a loss-maker once all relevant overheads are accurately allocated.

Allocating Fully Reciprocated Costs to Production Departments

These insights can lead to more informed decision-making and strategic adjustments, ultimately enhancing organizational efficiency and profitability. The three methods for stage 1 allocations are illustrated in the example provided below. Understanding the different methods of cost allocation is fundamental for any organization seeking to manage its finances effectively. Each method offers unique advantages and is suited to specific organizational structures and needs. For example, suppose the Virginia Chicken Company can sell chicken parts such as feet, beaks and gizzards for five cents per pound at the split-off point.

Of course this creates an inventory valuation problem from the financial reporting perspective asindicated above. In addition, these allocations have some rather senseless implications from the decision perspective, e.g., the company would be moreprofitable if it produced chickens with only breasts and wings. The denominator for the proportions of service provided from S1 to P1 and P2 is 900, not unreimbursed employee expenses what can be deducted 950 and the denominator for the proportions of service provided fromS2 to P1 and P2 is 250 not 300. This is because the self service hours are ignored as well as the 20 hours provided to Power.Since the Power Department has already been closed, no costs are allocated from Maintenance to Power. 3) Solve the equations developed in [2] to determine the allocations to the producing departments.

Calculating Fully Reciprocated Costs

- D’s overheads would be similarly reapportioned on the basis of 75/95 and 20/95.

- For example, the power departmentprovides electric power to the maintenance department and the maintenance department provides repair and maintenance to the power department.

- The self services (the 50 KWH’s used by S1 and the 30 labor hours used by S2) are ignored along with the reciprocal services (the 100 KWH’s used by S2and the 20 labor hours used by S1) in developing the proportions.

- This problem is eliminated by using the single budgeted rate method illustrated below.

The General Products Company is a manufacturing firm with six service departments and five producing departments. Many of the service departments serve each other in addition to providing service to the producing departments. The various departments and applicable variable direct cost, (i.e., the cost identified with these departments before reciprocal service cost allocations) are presented in Table 1 for the most recent accounting period. The service departments and allocation proportions for the direct variable costs appear in the lower part of Table 1. In addition to allocating costs for inventory purposes, management needs accurate cost allocations for a make or buy decision.

In determining the sequence of allocations, ties can be broken by using the alternative approach. If there is still a tie, thenchoose the department with the largest dollar amount of service provided to the other service departments. In the step-down method, no costs are allocated (orreallocated) back to a service department once the service department’s costs have been allocated. The first step involves developing equations to reflect the relationships between the service departments and the producingdepartments, i.e., equation form [2] presented above. After these equations are developed, they are used to allocate the service department costs directly tothe producing departments in the second step.

This problem is eliminated by using the single budgeted rate method illustrated below. A plant wide rate based on either direct labor hours or machine hours would provide the same product costs as separate department rates based on these measurements.b. A plant wide rate based on direct labor hours would provide the same product costs as separate departmental rates based on direct labor hours.c. A plant wide rate based on machine hours would provide the same product costs as separate departmental rates based on machine hours.d.

The Virginia Chicken Company combines a poultry business with a chain of restaurants that specialize in southern fried chicken. Two joint products emerge at the point of separation,or split-off point. The details for a recent accounting period are provided in Exhibit 6-16.Joint cost allocations are presented in Exhibit 6-17 based on the four allocation methods discussed above. 1) Develop equations for each department fully recognizing all the reciprocal relationships and self services. The equations for the reciprocal method are also developed fromequations [1] and [2] above.

The company has always generated its’ own electric power since the plant was built in a rather isolated area of the northwest. However, a new public utility has recently offered to provide electric power to the plant for 4.5 cents per kilowatt hour. As a result the firm’s management needs to know how much cost could be avoided if the electric power plant were closed, and how much electricity would be needed if it were purchased externally. The company used three million kilowatt hours of electricity during the previous period. A third method, referred to as activity based product costing, also involves a two stage allocation process where the first stage is essentially the same as in thetraditional two stage approach.